ताज़ा खबर

UP में जमीन खरीदना-बेचना हुआ और भी सख्त! खतौनी से मैच होना चाहिए मालिक का नाम, वरना रजिस्ट्री दफ्तर से लौट आएंगे खाली हाथ

यूटिलिटी

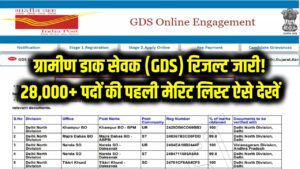

करियर

GyanOk Quiz

खेल समाचार

T20 World Cup 2026 Final Quiz: केवल सच्चे क्रिकेट फैन ही 10/10 स्कोर कर पाएंगे!

ताज़ा खबर

राज्य न्यूज़

मनोरंजन